Your Trusted Mortgage Broker

EVERY MORTGAGE IS UNIQUE.

LET ME HELP YOU FIND YOURS.

Understanding mortgage financing can be difficult, it doesn't have to be, here's the plan!

STEP ONE

Connect with me!

The process starts when you let me know you'd like to talk about your mortgage. I'm happy to take a look at your financial situation and put together a plan for your first/next mortgage!

STEP TWO

Discuss your options.

When it comes to mortgage financing, you have a lot of options! When you work with me, I clarify those options, so you can make the decision that best suits your needs.

STEP THREE

Arrange the paperwork.

Handling the paperwork is the nitty gritty of mortgage financing. And this is where I shine!

I make sure you know exactly what is required

of you at every step, limiting any delays.

STEP FOUR

Lifetime support.

I've worked with clients just like you for almost 15 years. I'm not going anywhere!

So as long as you need a mortgage, you can trust that I will be there for you!

I am an experienced Mortgage Broker of Integrity with an MBA.

Every mortgage I recommend has to pass muster with the following question: “If I were this borrower, would this be the mortgage I would recommend for myself?"

A family man married for more than 25 years, with 3 children, I’ve worked in finance and consulting for 16 years, and 8 years specifically in mortgages. I’ve owned rental properties, renovated houses done commercial equipment leasing and owned a restaurant franchise. I’ve seen a lot, and financed a lot for myself; so I know from personal experience how hard it can be for the self-employed person.

I do purchase financing, refinances, consolidations of debt, CRA payouts, consumer proposal payouts and commercial mortgages. I have access to a lot of private money, and I LOVE solving difficult situations – quite often, the banks themselves will send mortgages to me that they can’t do in-house. I’ve had lots of folks crying on the other side of the table as they recount the difficult circumstances such as job loss, illness or divorce that led them to my office. Many of those folks were crying with joy later when I found a solution that allowed them to keep their home. If you’ve got equity, you’ve got hope!

Things are tough for many, and with borrowing rules constantly changing, a steady hand is needed to navigate the mortgage landscape. Even strong borrowers loyal to their bank are finding that their bank is not loyal to them.

Your situation is unique, and my solutions are catered to your needs, not the bank’s.

My clients know that I never stop trying for them, because it's not just your mortgage – it’s ours.

Take care and talk soon,

-Kevin

What My Clients Are Saying

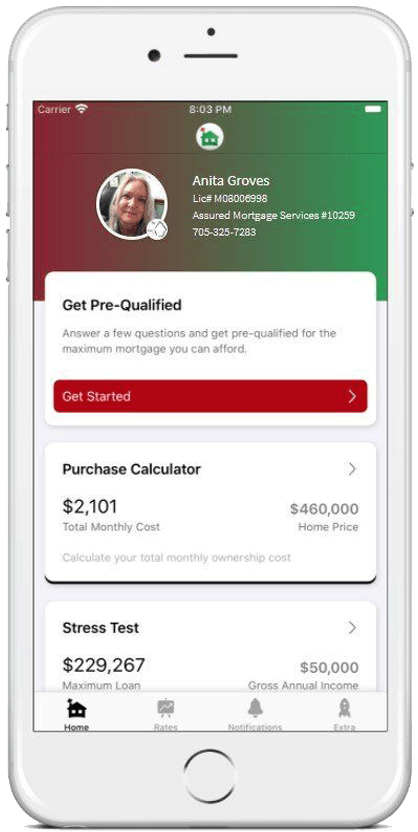

Everything you need, all in one place

Know the right mortgage product for your circumstance.

Resources

Looking for some more information? Read through my blog.